Online payment systems have made it easier than ever to pay land taxes in Kerala. Paying land taxes is an essential duty for landowners and property holders that helps the state’s development projects. Kerala’s online land tax payment system provides a convenient way to fulfil this obligation from the comfort of your home, so long lines and tiresome paperwork are a thing of the past. We’ll walk you through the advantages, prerequisites, and detailed instructions for online land tax payment in this blog post to make sure it goes smoothly. This guide will make it easy for you to use the system, regardless of whether you’re a first-time payer or trying to streamline your procedure.

Step-by-Step Guide to Pay Land Tax Online in Kerala

In Kerala, paying your land tax online is a simple procedure that saves time and effort. You can easily complete your payment and navigate the official portal with the help of this guide’s clear instructions.

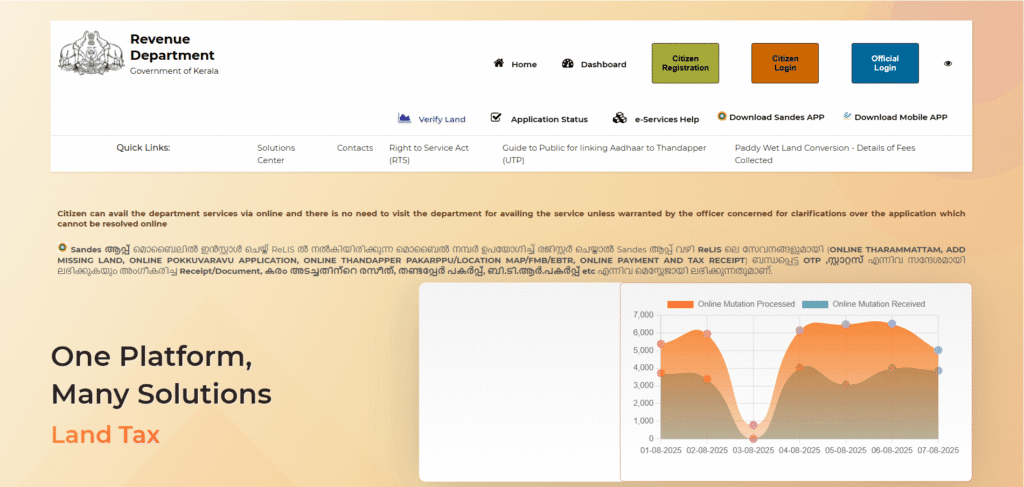

Step 1: Visit the Official Portal

- Action: Access the official Kerala Revenue Department portal or the e-Sevana platform, which facilitates online land tax payments.

- Website: The primary portal is typically the Kerala Revenue Department’s website (

http://revenue.kerala.gov.in) or the e-Sevana portal (http://esevana.kerala.gov.in). - Tip: Ensure you’re on the official website by verifying the URL to avoid fraudulent sites. Bookmark the link for future use.

- Note: If the exact URL changes, check the Kerala government’s official website for updated links.

Step 2: Register/Login

- Action: Create an account or log in to the portal.

- For New Users:

- Click on the “Register” or “Sign Up” option.

- Provide details like your name, mobile number, email, and Aadhaar number (if required).

- Set a secure password and verify your account via OTP or email confirmation.

- For Existing Users:

- Click “Login” and enter your registered mobile number/email and password.

- If you’ve forgotten your password, use the “Forgot Password” option to reset it via OTP.

- Tip: Keep your login credentials handy for quick access.

Step 3: Locate Land Tax Payment Section

- Action: Navigate to the land tax payment section on the portal.

- Instructions:

- On the homepage, look for options like “Online Services,” “Tax Payment,” or “Land Tax.”

- Select “Land Tax Payment” or a similar option from the menu.

- You may need to choose your district or local body (e.g., panchayat, municipality) to proceed.

- Tip: If you can’t find the section, use the portal’s search bar and type “land tax payment” or check the FAQ/help section.

Step 4: Enter Property Details

- Action: Input the required property details to identify your land.

- Details Needed:

- Survey Number: The unique number assigned to your land parcel.

- Thandaper Number: A unique identifier for your property in the revenue records.

- Village/Taluk/District: Select the appropriate location details from dropdown menus.

- Instructions:

- Locate these details in your property documents or previous tax receipts.

- Enter the details carefully to avoid errors.

- Some portals may allow you to search by owner name or property address if the survey/thandaper number is unavailable.

- Tip: If you’re unsure about your property details, contact your local Village Office or Revenue Department for assistance.

Step 5: Verify and Calculate Tax

- Action: Review the tax details displayed by the system.

- Process:

- After entering property details, the portal will display the tax amount due, including any pending dues or penalties for late payment.

- Verify the property details (e.g., owner name, location, tax amount) to ensure accuracy.

- The system may show a breakdown of the tax, such as the base amount and any additional fees.

- Tip: If the tax amount seems incorrect, double-check your property details or contact the helpline before proceeding.

Step 6: Make Payment

- Action: Complete the payment using the available methods.

- Payment Options:

- UPI: Use apps like Google Pay, PhonePe, or BHIM by entering your UPI ID or scanning a QR code.

- Net Banking: Select your bank from the list and log in to authorize the payment.

- Debit/Credit Card: Enter card details (card number, expiry date, CVV) and authenticate with an OTP or password.

- Instructions:

- Choose your preferred payment method from the portal’s payment gateway.

- Follow the prompts to complete the transaction securely.

- Tip: Ensure a stable internet connection to avoid payment interruptions. Save any transaction reference number displayed.

Step 7: Download Receipt

- Action: Save the payment confirmation for your records.

- Importance:

- The receipt serves as proof of payment and is useful for resolving disputes or for future reference.

- It includes details like the transaction ID, date, amount paid, and property information.

- Instructions:

- After successful payment, the portal will display a confirmation page with an option to download the receipt as a PDF.

- Click “Download Receipt” or “Print” to save the file to your device.

- If the download fails, check your account’s transaction history or “My Payments” section to retrieve the receipt later.

- Tip: Store the receipt digitally and consider printing a hard copy for your records.

You can easily maintain compliance and pay your Kerala land tax online by following these steps. See the help section of the portal or call the official helpline for assistance if you run into problems.

Prerequisites for Online Land Tax Payment in Kerala

To pay land tax online in Kerala, you need to gather specific documents and details to ensure a smooth process. Below is a clear list of the required documents and information:

- Property Details:

- Survey Number: The unique identifier for your land parcel, found in your property deed or previous tax receipts.

- Thandaper Number: A unique code assigned to your property in the revenue records, available in property documents or from your local Village Office.

- Village/Taluk/District: Location details of the property, which you may need to select from dropdown menus on the portal.

- Tip: If you don’t have these details, check your property documents or contact your local Village Office or Revenue Department.

- Valid Identification:

- Aadhaar Number or other ID (e.g., Voter ID, PAN): Required during registration on the portal (e.g., Kerala Revenue Department or e-Sevana) to verify your identity.

- Mobile Number and Email: Needed for registration, OTP verification, and receiving payment confirmations.

- Tip: Ensure your mobile number is active, as OTPs are sent for login and payment verification.

- Payment Method:

- Bank Account Details: For net banking, you’ll need access to your bank’s online banking credentials.

- UPI ID: For UPI payments via apps like Google Pay, PhonePe, or BHIM.

- Debit/Credit Card: Card number, expiry date, and CVV for card-based payments.

- Tip: Verify that your payment method is active and has sufficient funds before initiating the transaction.

- Optional: Previous Tax Receipt:

- Helpful for cross-checking property details or resolving discrepancies in tax dues.

- Tip: If you’re a first-time payer, this may not be necessary, but it’s useful for recurring payments.

FAQs: Kerala Land Tax Online Payment

Below are answers to common questions about paying land tax online in Kerala to help you navigate the process with ease.

1. What if I don’t know my survey number or thandaper number?

- Answer: Your property deed, prior tax receipts, or land records may contain the survey and thandaper numbers. Visit your neighbourhood Village Office or call the Kerala Revenue Department helpline (contact information is available on the official website) if you are unable to locate them. If the system permits, you can also try searching the portal with your name or the address of your property.

2. Can I pay land tax for multiple properties at once?

- Answer: Yes, you can add more than one property to your account on the majority of portals (like e-Sevana and the Kerala Revenue Department). Depending on the portal’s options, enter the survey and thandaper numbers for each property separately, confirm the tax obligations, and make a payment either individually or jointly. For instructions, consult the particular interface.

3. Is there a penalty for late payment of land tax?

- Answer:Yes, in accordance with Kerala’s revenue regulations, late payments may result in penalties or interest. The length of the delay and local laws determine the precise penalty. When you enter the details of your property, the online portal usually shows any outstanding fees or penalties. Pay by the due date to avoid penalties (for deadlines, check the portal or local announcements).

4. What should I do if the payment fails but the money is deducted?

- Answer: If the payment fails but your account is debited:

- Note the transaction ID and check your bank statement.

- Wait for 24–48 hours, as failed transactions are often refunded automatically.

- If not refunded, contact the portal’s helpline (available on the official website) or your bank with the transaction details.

- Download the receipt from the portal’s transaction history to verify if the payment was recorded.

5. Can I pay land tax online without registering on the portal?

- Answer: While guest payments may be available on certain portals, secure access and payment history tracking typically require registration. A more efficient procedure and easier access to receipts are guaranteed when you register on the Kerala Revenue Department’s or e-Sevana portal using your email address and mobile number.

6. What payment methods are accepted for online land tax payment?

- Answer: The official portals typically accept:

- UPI: Via apps like Google Pay, PhonePe, or BHIM.

- Net Banking: Through major banks listed on the portal.

- Debit/Credit Cards: Visa, MasterCard, etc., with OTP authentication.

Check the portal’s payment gateway for the full list of options.

7. How do I get a receipt after paying the land tax?

- Answer: After successful payment, the portal (e.g.,

http://revenue.kerala.gov.inorhttp://esevana.kerala.gov.in) displays a confirmation page with a “Download Receipt” or “Print” option. Save the PDF to your device. If you miss it, check the “My Payments” or “Transaction History” section of your account to retrieve it.

8. What if the portal is down or shows technical errors?

- Answer: If you encounter technical issues:

- Try again after some time, preferably during non-peak hours.

- Clear your browser cache or use a different browser/device.

- Contact the portal’s helpline or email support (listed on the official website) for assistance.

- Avoid making multiple payment attempts to prevent duplicate transactions.

9. Can I pay land tax through a mobile app?

- Answer: You can use a mobile browser to access the portal even though the Kerala Revenue Department, also known as e-Sevana, does not currently have a specific mobile app for paying land taxes. If UPI apps are integrated with the portal, use them to make payments or check the official website for any updates on mobile apps.

10. How do I know the due date for my land tax payment?

- Answer: Due dates are frequently announced on the official portal or through notifications from the local government, and they differ depending on the local body (panchayat, municipality, etc.). Enter your property information, log in to the portal, and look for any due dates or outstanding balances. Contact your Village Office for specific deadlines.

For additional queries, visit the official Kerala Revenue Department website (http://revenue.kerala.gov.in) or e-Sevana portal (http://esevana.kerala.gov.in) for support contacts and further details.