An Encumbrance Certificate (EC), which certifies that a property is free from financial or legal obligations, is an essential document for anyone engaged in real estate transactions in Andhra Pradesh. An EC guarantees security and transparency whether you’re purchasing, selling, or requesting a loan secured by real estate. Due to Andhra Pradesh’s efforts to promote digital governance, obtaining an EC online is now a straightforward process that saves time and effort. You can quickly obtain this certificate via the official IGRS or MeeSeva portals by providing the property’s survey number. We’ll walk you through the entire process of downloading an EC online in Andhra Pradesh in this guide, ensuring you have all the necessary information for a seamless experience.

What is an Encumbrance Certificate?

An important legal document that certifies a property’s freedom from financial and legal obligations is an Encumbrance Certificate (EC). It serves as formal proof that a property has a marketable and clear title, which is crucial for any real estate deal. Any charge or claim on a property, such as a loan, lien, or legal dispute, is referred to as an “encumbrance” and can limit the owner’s ability to transfer ownership.

An EC’s main function is to offer a historical record of all transactions that have been registered for a particular property over a given time period. This guarantees openness and aids in confirming the seller’s authority to transfer the property. A “Nil Encumbrance Certificate” is granted if no transactions or liabilities are recorded against the property for the designated time frame.

Step-by-Step Guide to Download Your Encumbrance Certificate (EC) Online in Andhra Pradesh

Step 1: Visit the Official Portal

You must first go to the appropriate government website.

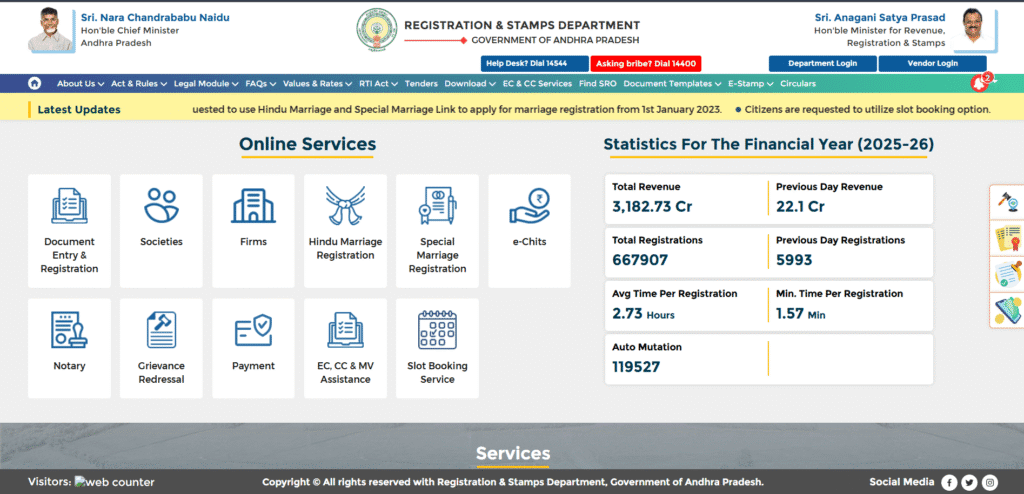

- Main Portal: Go to the official Andhra Pradesh IGRS (Registration and Stamps Department) website by opening your web browser.

- Alternative Platform: The MeeSeva portal, which serves as a single platform for the delivery of numerous government services, is another way that you can use this service. But in the end, it will take you to the EC service’s IGRS portal.

Step 2: Register or Login

To download a legally valid, digitally signed EC, you must have an account.

- For New Users (Registration):

- On the IGRS homepage, look for a ‘Login’ or ‘Register’ button, usually at the top right corner.

- Click on it and select the ‘Citizen Registration’ option.

- Fill in the required details, such as your name, address, email ID, mobile number, and Aadhaar number. Create a username and password.

- You will receive an OTP (One-Time Password) on your registered mobile number for verification. Enter the OTP to complete the registration.

- For Existing Users (Login):

- Click on the ‘Login’ button.

- Enter your username, password, and the captcha code shown on the screen.

- Click ‘Submit’ to log in to your dashboard.

Step 3: Navigate to the EC Section

Once you are logged in, you need to find the Encumbrance Certificate service.

- On the main page or within your user dashboard, look for the ‘Services’ section.

- Click on ‘Encumbrance Search (EC)’. This is the specific service you need to access.

Step 4: Enter Property Details

This is the most crucial step where you will use your survey number. The system offers different ways to search, but for a land-based search, you will primarily use property details.

- On the Encumbrance Search page, you will be presented with search criteria. Since you are searching with a survey number, select the search parameter as ‘None’ when asked to search by ‘Document No’ or ‘Memo No’.

- You will then see a form to enter the property details. Fill it out accurately:

- District: From the dropdown menu, choose the appropriate district. Sub-Registrar Office, or SRO: Choose the Sub-Registrar Office that has jurisdiction over your property. Your sale deed contains this information. Time Frame for the Search: Enter the start and end years for which the certificate is required. Searching for at least the last 15 to 30 years is advised. Survey Number: This is the most important field. Enter the Survey Number for the property carefully. There may be distinct fields on some forms for the subdivision number and the primary survey number.

- The form might also have fields for Plot No. or House No./Apartment Name. Fill these in if applicable, especially for properties in urban areas.

Step 5: Submit Application and Make Payment

After filling in all the details, proceed to the final steps.

- Click the ‘Submit’ button at the bottom of the form.

- The system will display a preview of the transactions found for your property within the specified period. A ‘Nil Encumbrance Certificate’ will be indicated if no transactions are found.

- To get a legally valid, digitally signed copy, you will be prompted to proceed to payment. The fee for a signed EC is nominal.

- You will be redirected to a payment gateway. You can typically pay using:

- Net Banking

- UPI (Google Pay, PhonePe, etc.)

- Debit Card or Credit Card

- Complete the payment process. You will receive a transaction ID or an application number for future reference.

Step 6: Check Status and Download the EC

The time it takes to generate the certificate can vary.

- Processing Time:The digitally signed EC may be available for download almost immediately or in a matter of hours for the most recent and clearly indexed records. It could take a day or two for older records (pre-computerisation, for example), as the SRO may need to manually verify them.

- How to Download:

- Log back into your IGRS portal account.

- Navigate to a section named ‘My Applications’, ‘Transaction History’, or a similar dashboard area.

- Find your EC application using the transaction ID.

- You will see the status of your application. Once it shows ‘Approved’ or ‘Ready for Download’, you will find a download link.

- Click the link to download the Encumbrance Certificate. It will be a PDF file with a digital signature, making it an official and legally valid document.

By following these steps, you can successfully download your property’s Encumbrance Certificate directly from the AP IGRS portal using its survey number.

Requirements Documents

- Valid Survey Number of the Property:The most important piece of information is this one. In government records, a parcel of land is uniquely identified by its survey number and, if applicable, its subdivision number. This number is used by the online system to precisely locate the property and obtain its transaction history.

- Internet-Enabled Device: You will need a computer, laptop, smartphone, or tablet with a stable internet connection to access the Government of Andhra Pradesh’s IGRS portal.

- Specific Property Location Details: To narrow down the search in the government database, you must know the exact administrative location of the property. This includes:

- District: The district where the property is located.

- Mandal: The mandal under which the property falls.

- Village/Town: The specific village or town name.

- SRO (Sub-Registrar Office): You must know which Sub-Registrar’s Office has jurisdiction over the property’s location, as transactions are registered at the SRO level.

The Importance of an Encumbrance Certificate

The Encumbrance Certificate is essential for various parties involved in a property transaction for the following reasons:

- For Property Buyers: The EC is the main verification tool used by buyers. It helps them confirm that there are no financial or legal restrictions on the property they want to buy. A buyer can verify that there are no unpaid loans, mortgages, or active legal claims that might be inherited with the property by looking over the EC. This gives the buyer peace of mind and shields them from future legal issues and possible fraud.

- For Property Sellers:Presenting a clear Encumbrance Certificate to prospective buyers can greatly increase the property’s legitimacy and inspire confidence in the seller. It acts as evidence of a clear title, which can speed up the selling process by assuring purchasers that there won’t be any legal complications and that the transaction will go smoothly.

- For Loan Applicants: Before giving a home loan or a loan secured by real estate, banks and other financial institutions require the submission of an Encumbrance Certificate. The EC is used by lenders to make sure that the property being offered as collateral is free of liabilities and hasn’t already been pledged to another lender. A clear EC, which attests to the property’s value as a security, is an essential part of the loan underwriting procedure.

Details Included in an Encumbrance Certificate

An Encumbrance Certificate provides a comprehensive summary of all registered dealings associated with a property. The key details typically included are:

- Property Description: This includes the full address, survey number, and a detailed description of the property as recorded in the official sale deeds.

- Chain of Ownership: The EC lists all the recorded transactions, showing the sequence of owners. It details sale deeds, partition deeds, gift deeds, and other forms of property transfer.

- Mortgages and Liens: Any loans or mortgages secured by the property are specifically mentioned. This contains information about the loan amount, the date of the transaction, and the lender (bank or individual). The associated release deed should also show whether a loan has been paid back.

- Other Legal Claims: Any other registered claims, such as court attachments, leases, or government liens, will be detailed in the certificate.

- Transaction Period: The certificate specifies the period for which the records have been searched, which is typically requested for 15 to 30 years.

FAQs:

Q1: What is the difference between a regular EC and a ‘Nil Encumbrance Certificate’? A: A regular EC lists all transactions. A ‘Nil EC’ confirms there were no registered loans or transactions during the searched period, meaning the record is clear.

Q2: For how many years should I request an EC? A: It is best practice to get an EC for the last 30 years for a thorough check, as required by most banks and legal advisors.

Q3: Is an EC the same as a Sale Deed? A: No. A Sale Deed transfers ownership. An EC is a report of a property’s financial liabilities (like loans) and transaction history.

Q4: Is downloading the EC free in Andhra Pradesh? A: Viewing the statement is free. However, downloading the official, digitally signed EC requires a small fee to be paid online.

Q5: How can I get an EC in Kavali without a computer? A: Visit your nearest MeeSeva Kendra or the Sub-Registrar’s Office (SRO) in Kavali. They can apply online for you for a service charge.

Q6: How long does it take to get the EC online? A: It’s usually instant or within a few hours. For older, non-computerized records, it might take 1-2 working days.

Q7: I don’t know my property’s survey number. How do I find it? A: Check your old Sale Deed or Title Deed. If unavailable, inquire at the local Village Revenue Officer (VRO) or Mandal Revenue Office (MRO).

Q8: How do I get an EC for an apartment? A: The easiest way is to search using the document number of your registered sale deed. Alternatively, use the land’s survey number along with your flat number.

Q9: What happens if I enter the wrong survey number? A: You will get an EC for the wrong property or a “no data” error. The certificate will be incorrect and invalid for your use.

Q10: Is the EC downloaded online legally valid for a bank loan? A: Yes. It is digitally signed by the Sub-Registrar, making it an official and legally valid document accepted by all banks.

Q11: My EC shows a loan that I have already paid off. What should I do? A: You must register a ‘Release Deed’ (loan closure document) from your lender at the Sub-Registrar’s Office to officially update the record.

Q12: What does “No data available” mean on the portal? A: It means either the property is clear, you entered incorrect details (like survey number or SRO), or the records are not yet computerized. First, double-check that your input is correct.